TAILORED AND RESILIENT CAPITAL SOLUTIONS FOR MIDDLE MARKET BUSINESSES AND BUSINESS OWNERS

TAILORED AND RESILIENT CAPITAL SOLUTIONS FOR MIDDLE MARKET BUSINESSES AND BUSINESS OWNERS

Equity Strategies

Equity strategy serves as the ultimate shock absorber, helping companies balance the two core tensions of growth and succession – specifically the scarcities of cash, talent, and confidence for succession. Thus, capital structure is the second core element of the BOLD Value Value Architecture.Through our BOLD Value approach, our team help clients refresh their capital structures for each stage of growth.

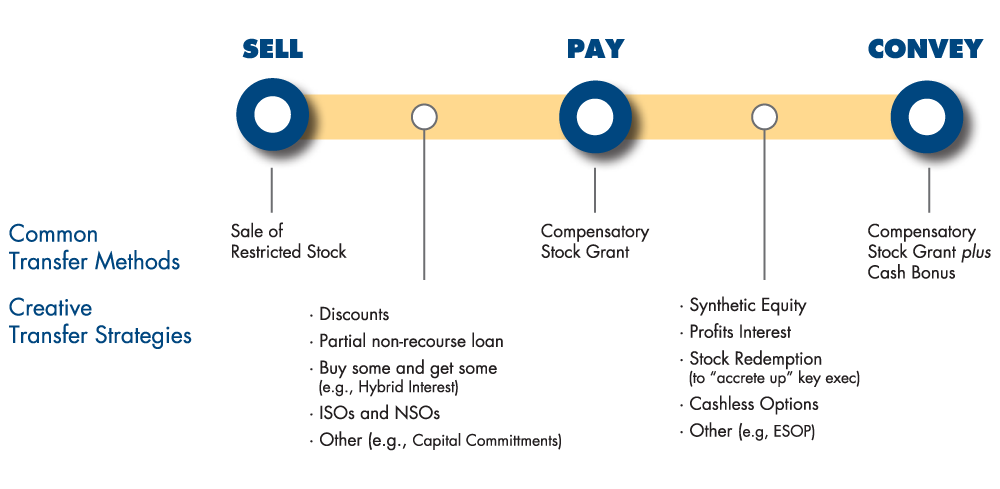

Note: ISO = Incentive Stock Option, NSO = Non-Qualified Stock Option and ESOP = Employee Stock Ownership Plan

We seek to strengthen companies by refreshing their capital structure:

Structure to attract and reward various strategic owners (including passive owners) such as C, S, LLC, tiered LLCs, spinoffs and asset sales, real estate, M&A holding company

Buy-sell agreements and valuation

The Art of Equity Transfer via the Sell·Pay·Convey® methodology

Access to capital (equity and debt) and elimination of personal guarantees

Tax reduction strategies for potential change in control

Estate planning strategies overlay on the firm capital structure – especially for family businesses

Overlay of qualified and nonqualified compensation plans such as phantom stock and ESOPs

Support for leadership succession, capital succession,and business succession.

The ultimate goal of our work on capital structure: strengthen the resiliency of the business so it can thrive across the myriad stages of growth and succession.