Strategic

Incentives

Cash performance

awards for the digital

economy

by Mark Bronfman MBA, CPA*, Sagemark Consulting

Executive Summary

Long-term cash incentive plans are an essential strategic weapon in the war for talent for privately held companies. But we find many CEOs and board members are dissatisfied with the outcomes produced by these cash awards. The plans fail to reinforce the core growth strategy for the company, fail to resonate emotionally with key talent, and fail to empower owner succession.

The core problem: Too many long-term cash (“LT Cash”) plans are force-fitted, rather than customized, to stakeholder needs. Further, LT Cash designs have not kept up with the rapidly changing demands of the digital economy. We see CEOs and boards playing catch-up (as in a game of Whac-A-Mole) instead of treating LT Cash plans as true strategic incentives deserving serious attention.

LT Cash plans need to be designed to achieve better outcomes. First, they should promote the “new” innovation and agility needed for sustainable growth in the digital era, not just the “now” of profit generation. Second, they should nurture key talent and the capabilities on which the company’s future depends, not just reward executive retention. Third, they should advance owner succession plans, not just perpetuate the ownership and leadership of the enterprise.

To achieve these goals, we’ve created an improved design process for LT Cash plans that is driven by five imperatives. These imperatives result in more agile, effective, and affordable long-term cash incentives.

Purpose

Reinforce the purpose of the founder, company and execs

Eligibility

Address the eligible population delivering core capability

Metrics

Spotlight the metrics that matter tomorrow, as well as today

Sizing

Resonate emotionally with key talent through sizing

Platform

Achieve tax efficient and flexible designs via a select platform

Read on to learn what it takes to design LT Cash awards that fully deliver on their promise.

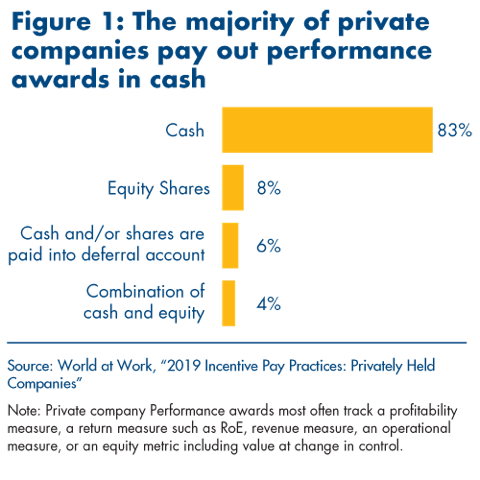

A better plan design process

An overwhelming majority of private companies utilize long-term cash incentives to drive corporate performance and win the war for talent (see Figure 1). But, based on our experience, many CEOs and board members are dissatisfied with the performance of these awards. The dirty secret of LT Cash is the desperate need for better metrics, better eligibility, better sizing, and better design from top to bottom.

We are often asked to correct LT Cash Plans. The typical private company “we can do better” stories include:

- Shaping a LT Cash plan without regard to the true purpose of the founder, company, and execs.

- Awarding executive compensation based solely on tenure or seniority, versus capabilities.

- Capping the dollar value of cash awards when other employers are offering uncapped equity awards.

- Conflating performance management systems (OKRs, etc) with performance pay.

- Jumping into an executive compensation “platform” solution without doing the prerequisite design work.

How did we get here? From nonqualified deferred compensation to cascaded bonus plans, LT cash awards have failed to keep up with the times. Three trends have made the design process for certain cash plans obsolete.

Sources of value have shifted: There has never been such a wide gap between profit performance and company valuation. Companies focused on technology and innovation, such as those in the NASDAQ 100, regularly trade around 40 times profits while “value” companies trade at less than one-third of that. 1 Meanwhile, in this digital era, 84% of the market value of the S&P 500 is derived from human capital, value premium, and intangible assets, reflecting a company’s ability to pivot at full speed for next generation corporate growth. 2

- Is your LT Cash plan promoting the “now” of profit generation or the “new” of innovation and agility needed for long-term sustainable growth?

Our aim with this paper is to kickstart honest conversations about what is wrong with LT cash plans and how we can do better.

The war for capabilities is escalating: Today, the best and the brightest employees — those who can deliver in-demand capabilities — can work for any company, anywhere in the world, often from their home offices. And these key employees are just as likely to be found deep in the management ranks as in executive suites. Companies that simply reward loyalty and longevity are missing out to organizations that emphasize capability development.

- Is your LT Cash plan simply rewarding executive retention or fostering the key talent on which the company’s future depends?

Options for owner succession are expanding: Easy access to capital has dramatically expanded the opportunities for owner succession. Historically, over 80% of private company owners were in a “stay and grow” mode. 3 Today, private equity, ESOPs, outright sale, partnerships, and intergenerational transfer strategies are all blossoming. As a result, executive compensation is often misaligned with owner succession strategies.

- Is your LT Cash plan impeding or advancing your ownership succession plan?

The good news is that the above trends associated with the digital economy are not inherent flaws in LT Cash plans themselves. Indeed, along with equity-based plans, LT Cash plans remain an essential element in the compensation packages offered to key talent by private companies (see below). 4

It’s time for a more deliberative design of LT Cash incentives.

When well-designed, LT Cash incentives denominated in top-line, bottom-line, and/or business unit performance are an elegant solution to the liquidity and affordability problem in private companies. They feature finite awards. Payouts typically are known in advance and they are directly linked to performance – so the cash plans can be funded from company profits. LT Cash plans designed as rewards, not entitlements, can become more powerful drivers of motivation and achievement across all stakeholders.

Successful LT Cash design encompasses the long-term needs of the three primary stakeholders: owner/founders, the company itself and the key employees. This better holistic process to LT Cash plans is built on the foundation of five core design imperatives: purpose, eligibility, metrics, sizing and platform. (see Figure 2).

Figure 2: Long Term Cash Design Imperatives for the Digital Economy

Purpose

Reinforce the purpose of the founder, company and execs

Eligibility

Address the eligible population delivering core capability

Metrics

Spotlight the metrics that matter tomorrow, as well as today

Sizing

Resonate emotionally with key talent through sizing

Platform

Achieve tax efficient and flexible designs via a select platform

The goal of the five imperatives is to surface possibilities and clarify choices about the strategic incentives that will best balance and serve the needs and desires of the plan’s stakeholders. In traveling through this process, top management teams can shine a light on both the internal human capital and external market forces that are driving their company’s future in a digital economy.

Imperative 1. Better purpose

“It all starts with Why,” declares Simon Sinek, who argues that the most inspiring leaders and companies all have one thing in common: They define their purpose, before they consider anything else. 5 The same idea holds true for designing effective incentives, including LT Cash plans.

Purpose in a company can seem like a Rubik’s cube: the three dominant stakeholders (owners, company, and talent) all need to be aligned with each other for the “now” and the “new.” The purpose of owners is often defined by growth, exit pathway, and acceptable level of risk. The purpose of the company is often defined by the nexus of customer needs and human capital strategy (which itself is barbelled with retention on one end and capabilities on the other end). Finally, the purpose of key employees is to manage the portfolio of company opportunities across the old, the new and the now — yielding fair rewards and career opportunities for the execs and the employee base.

Consider the perspective of owner/founders. Often, their purpose is to create a valuable and eventually transferable business. To achieve this, they usually have one of four succession pathways in mind: an outright sale to a 3rd party strategic or financial buyer; a perpetual business with a series of partner buy-ins and buy-outs; a keep-it-in-the-family model often with the assistance of a professional manager; or a transfer to employees via an ESOP or similar broad ownership plan. LT Cash plans must be aligned with their chosen succession pathway to achieve their purpose.

- Design Tip: A LT Cash plan should be tailored to support your end game. Consider all the key objectives across the major cash plan stakeholders: owners, the company and the key executives.

Imperative 2. Better eligibility

These days, the ability to identify and manage the inflection points that arise from new technologies, business models, and competitors is essential to corporate survival. Surprisingly, however, Columbia Business School professor Rita McGrath finds that it isn’t senior leaders who have this ability. “The real heroes of galvanizing the organization are typically elsewhere in the hierarchy,” she writes in her book Seeing Around Corners. 6 This suggests that owners should carefully consider the basis for eligibility in LT Cash plans (as well as other long-term incentives).

Traditionally, companies determine plan eligibility by role: A senior vice president is eligible for the plan, for instance, but a division head is not. This assumes that the most valuable employees in a company also occupy the top spots on the organizational chart. But what if the “real heroes” in your company are located elsewhere?

When this is the case, role may not be the best way to determine plan eligibility and you should consider shifting the focus of eligibility from role to capabilities. If it makes sense, you can offer LT Cash plans to your “high-performance club” — including those younger, mid-tier employees who are producing outsized results now and are likely create greater value in the future.

- Design Tip: LT Cash plans should strengthen and deepen your talent bench. As you define the eligibility requirements for your company’s LT Cash plans, consider who is creating long-term value in your company. Also consider a hybrid approach in allocating LT cash to recognize both outstanding individuals and team contributors.

Imperative 3. Better metrics

The German philosopher Arthur Schopenhauer said, “Talent hits a target no one else can hit; genius hits a target no one else can see.” Increasingly, companies need employees who can hit unseen targets, that is, the kinds of outcomes produced by as-yet-unimagined products, processes, and business models. But what kinds of metrics can link LT Cash plans to targets that you can’t see?

Venture capitalist John Doerr offers some insight. He argues that companies should not link compensation to the attainment of OKRs (objectives and key results), because that leads to less ambitious goal-setting and other tactics aimed at gaming the system. 7 This suggests that you should use metrics that link long-term incentives to strategic outcomes, not to short-term performance goals.

The shift from performance-management metrics to performance-pay metrics requires a shift from a focus on the customary quantity of earnings to the much more important quality of earnings (see Figure 3).

Talent hits a target no one else can hit; genius hits a target no one else can see.

Remember, all EBITDA is not equal: Some sources of EBITDA contribute to the future success of a company more than others, and some sources may not contribute at all. If the eventual sale or transfer of your business will be based on successful due diligence expressed as quality of earnings (aka, QofE), shouldn’t you apply that metric to your LT cash plan design?

- Design Tip: A LT Cash plan should articulate and emphasize the financial metrics that matter for the company. You will still vigorously measure forward-looking operational metrics via a performance management system, such as OKRs. But don’t conflate the management of leading indicators with the lagging outcomes of top-line and bottom-line performance.

Imperative 4. Better Sizing

Like it or not, private companies are competing for talent with public companies and, increasingly, with portfolio companies owned by private equity firms. These entities share value with executives either by using equity instruments or change in control carve-out plans. This is why we often suggest clients consider combination plans: one part equity (or synthetic equity, such as a value band plan) and one part LT cash performance plan.

If you are not prepared to consider a combo plan, then consider the next best alternative – an uncapped LT Cash bonus plan. Here’s why.

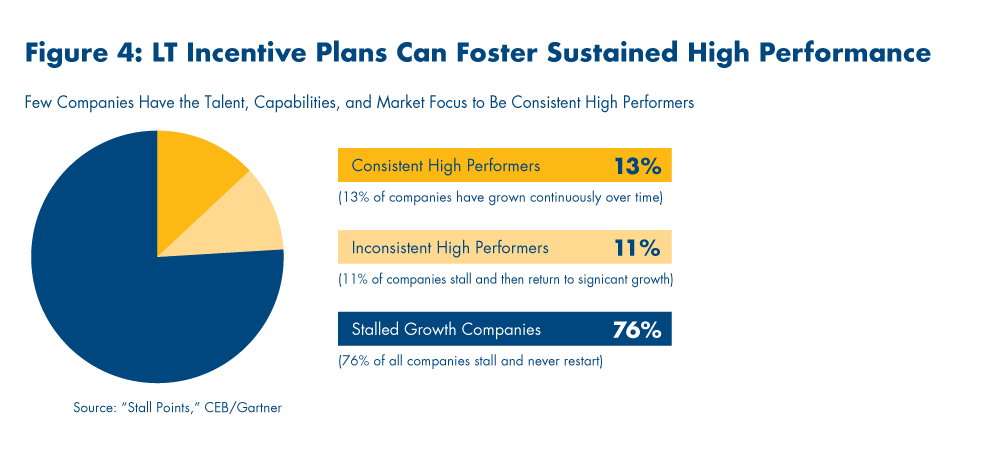

Historical studies from Bain, CEB/Gartner, and McKinsey all show that the fruits of business success go to a small set of out-performing winners, while many other companies that start out with promising growth eventually stall, fall, and often never recover (see Figure 4). For every Apple, there are many Blackberrys. Executives who guide the winners deserve to be treated fairly. The sizing of a LT Cash plan determines its fairness and motivational power.

The reward consideration isn’t about a number per se. Rather, it is a decision regarding whether the plan will offer a capped, percent-of-salary award or an uncapped, percent-of-profits award—an option that is unique to private companies. This requires that owners consider their financial obligations as the company steward and their own progress on the path to financial independence (as b-school professor Noam Wasserman put it, the choice to be “rich” or to be “king”). 8

If you haven’t achieved financial independence, you may not be ready to uncap cash rewards. But if you can uncap awards, you can also unleash employee energy—and that can generate a larger payoff for you, the company, and key employees in the long haul.

- Design Tip: One very important part of sizing is allocation of rewards. A LT Cash plan should respect the balance between “I” awards and “We” awards. “I” awards reward individual performance and individual performers, as in a sales organization. If your company depends on the collaborative efforts of employees, you may want to place greater emphasis on “We” awards that recognize group and team efforts.

Imperative 5. Better platforms

Too often, the leaders of private companies rely on “muscle memory” when it comes to determining the proper platform for LT Cash awards. As a result, they jump too quickly to accept an often flawed hypothesis that a cascaded bonus or a nonqualified deferred compensation platform, for example, is best for their company.

Instead, Boards and leaders should work through the first four design imperatives of purpose, eligibility, metrics, and sizing. Only then, with the insights and parameters of the previous imperatives in mind, should they turn to the task of choosing the best platform for their LT Cash plans.

Each of the platforms has its own characteristics and works best in certain situations (as follows). And each can and should be customized for your company.

Qualified Plans or qualified profit-sharing plans (QPS) offer advantaged tax treatment to both company and talent—qualified plans are tax deductible upon contribution and tax deferred after separation. These plans can be subject to vesting parameters. However, the size of the annual contribution is generally limited to $58,000 (2021). Thus, they are often adopted as one of the elements of the long-term incentive plans (LTIPs) of high growth companies.

Nonqualified Deferred Compensation (NQDC) is a good fit when there will be a combination of company and individual contributions. This platform supports materially flexible performance pay because the contribution size is practically unlimited, but it is also subject to claims of creditors. Companies with clearly delineated management groups often adopt this platform.

Split Dollar life insurance platforms reward loyalty with steady and stable annual contributions in a relatively flexible structure. They can run for long periods of 10-15+ years and work best for executive teams in their 30s, 40s and early 50s. They are often adopted by family-owned companies who want to retain non-family executives.

162 Bonuses enhance the retirement prospects of executives by allowing them to contribute company bonuses and their own money, having a long-term tax advantage that is potentially significant. They work best when there is a large enough group to qualify for simplified underwriting (typically 10+ execs) and when the executives are mid-50s or younger. They are usually adopted in companies whose owners value simplicity and flexibility.

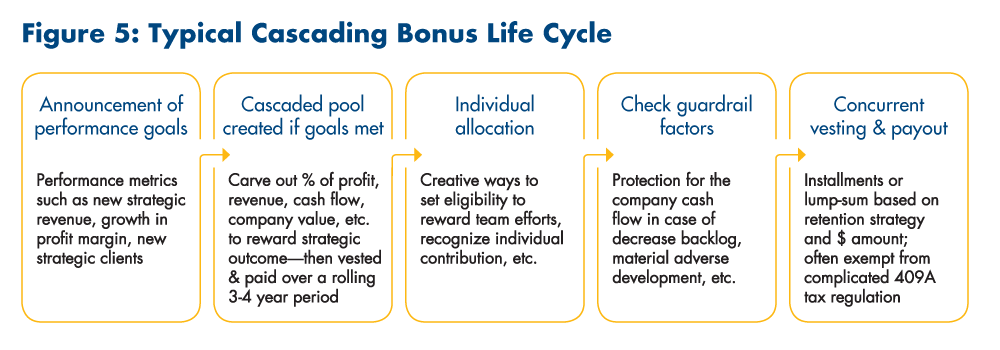

Cascaded Bonuses offer high levels of visibility and easy administration with their company deferral followed by a “vest & pay” regime. This platform is typically governed by an informal policy document versus a formal plan, and there is no limitation on the number of plan participants. It also offers material flexibility in the size of awards. Often, companies heading towards longer term change in control or having a perpetual partnership structure adopt this model, with participants using their mid-term cascaded bonuses to buy into the company.

- Design Tip: A LT Cash Plan platform should be accompanied by a plan specification document detailing how the purpose, eligibility, metrics, and sizing fit with the plan platform. A specification document is akin to an architectural blueprint –addressing around 100 “dials” from strategy, sizing, allocation, taxation and plan guardrails. Here is a simplified framework for a typical cascading bonus life cycle (see Figure 5).

Conclusion

The digital business world is a fundamental break from the past. Sources of value have shifted. The war for capabilities is escalating. Options for owner succession are expanding. Your LT cash plan design process needs to change with the times.

To ensure that your design process for LT Cash plans lives up to your company’s full potential, ask yourself the following three “balancing act” questions:

- Is your LT Cash plan promoting the “now” of profit generation or the “new” of innovation and agility for long term sustainable growth?

- Is your LT Cash plan simply rewarding executive retention or fostering the key talent magnet on which the company’s future depends?

- Is your LT Cash plan impeding or advancing your ownership succession plan?

Owners should consider each of the five design imperatives—purpose, eligibility, metrics, sizing, and platform—before they begin customizing their LT Cash plan. Those who do this will find that their cash performance awards will truly help their company perform.

End Notes

1 Invesco QQQ Trust as of June 2020 had an average price earnings ratio of 47.02 while the Invesco S&P 500 Pure Value ETF as of June 30, 2020 had a price earnings ratio of 12.27.

2 Bruce Berman, “$21 Trillion in U.S. Intangible Assets is 84% of S&P 500 Value,” IP CloseUp, June 4, 2019.

3 John Leonetti, results from the “BERI”, Business Exit Readiness Index study.

4 For a more deliberative list of design options of LT incentives, see Top 40 chart in the PDF version of this article.

5 Simon Sinek, “How great leaders inspire action,” TedxPuget Sound, September 2009.

6 Rita McGrath, Seeing Around Corners: How to Spot Inflection Points in Business Before They Happen, Houghton Mifflin Harcourt, 2019.

7 John Doerr, Measure What Matters: How Google, Bono, and the Gates Foundation Rock the World with OKRs, Portfolio, 2018

8 Noam Wasserman, “Rich versus King: The Entrepreneur’s Dilemma,” Academy of Management Annual Meeting Proceedings, 2006.

9 See “Synthetic Equity” white paper, Mark Bronfman, www.BoldValue.com

* Licensed, not practicing.

CRN-3379798-122220