TAILORED AND RESILIENT CAPITAL SOLUTIONS FOR MIDDLE MARKET BUSINESSES AND BUSINESS OWNERS

TAILORED AND RESILIENT CAPITAL SOLUTIONS FOR MIDDLE MARKET BUSINESSES AND BUSINESS OWNERS

Executive Compensation: Incentives

Executive compensation plans in privately-held, middle market companies need to be carefully designed to do a lot more than just serve as a catalyst for high performance. Incentive programs must:

Truly motivate for companies on the runway to both a change of control and change of leadership;

Optimize cash resources (especially for equity denominated awards);

Anticipate the evolving capital structure;

Empower succession;

Reduce tax costs for both the company and the executives; and

Sync up with the personal estate planning decisions of the ownership group.

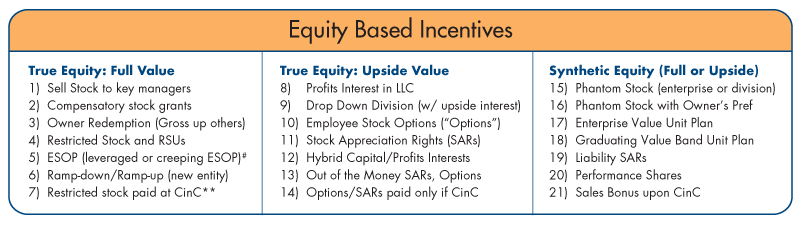

Top 40 Executive Rewards*: A Pathway to Strategic Advantage

| Equity Based Incentives | ||

|---|---|---|

| True Equity: Full Value | True Equity: Upside Value | Synthetic Equity (Full or Upside) |

| 1) Sell Stock to key managers | 8) Profits Interest in LLC | 15) Phantom Stock (enterprise or division) |

| 2) Compensatory stock grants | 9) Drop Down Division (w/ upside interest) | 16) Phantom Stock with Owner’s Pre |

| 3) Owner Redemption (Gross up others) | 10) Employee Stock Options (“Options”) | 17) Enterprise Value Unit Plan |

| 4) Restricted Stock and RSUs | 11) Stock Appreciation Rights (SARs) | 18) Graduating Value Band Unit Plan |

| 5) ESOP (leveraged or creeping ESOP#) | 12) Hybrid Capital/Profits Interests | 19) Liability SARs |

| 6) Ramp-down/Ramp-up (new entity) | 13) Out of the Money SARs, Options | 20) Performance Shares |

| 7) Restricted stock paid at CinC ** | 14) Options/SARs paid only if CinC | 21) Sales Bonus upon CinC |

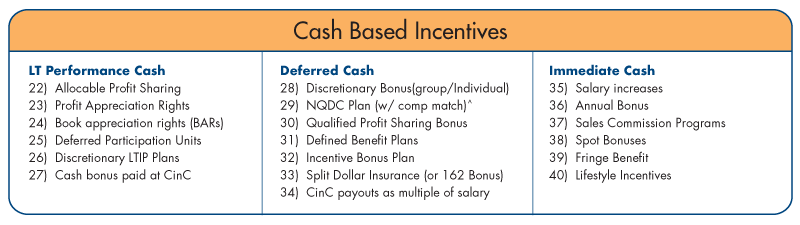

| Cash Based Incentives | ||

|---|---|---|

| LT Performance Cash | Deferred Cash | Immediate Cash |

| 22) Allocable Profit Sharing | 28) Discretionary Bonus (group/Individual) | 35) Salary increases |

| 23) Profit Appreciation Rights | 29) NQDC Plan (w/ comp match)^ | 36) Annual Bonus |

| 24) Book appreciation rights (BARs) | 30) Qualified Profit Sharing Bonus | 37) Sales Commission Programs |

| 25) Deferred Participation Units | 31) Defined Benefit Plans | 38) Spot Bonuses |

| 26) Discretionary Long-Term Incentive Plans | 32) Incentive Bonus Plan | 39) Fringe Benefit |

| 27) Cash bonus paid at CinC | 33) Split Dollar Insurance (or 162 Bonus) | 40) Lifestyle Incentives |

| 34) CinC payouts as multiple of salary | ||

* Incentives ranked from “Value Now” to “Value Later” (Value Now near top of each of six lists). #ESOP = Employee Stock Ownership Plan, **CinC refers to Change in Control, ^NQDC = Nonqualified Deferred Compensation