RESEARCH AND ANALYSIS

TOP 40 HIGH PERFORMANCE AWARDS

FOR STRATEGIC ADVANTAGE

RESEARCH AND ANALYSIS

TOP 40 HIGH PERFORMANCE AWARDS FOR STRATEGIC ADVANTAGE

Our research indicates that many owners, boards and advisors have a dangerous blind spot when it comes to rewards and succession. Owners default to executive rewards that are familiar, not necessarily those that are the “best-fit”. To shine a light on this blind spot, our BOLD Value team has crafted our list of most powerful high performance awards.

Reviewing over 100 rewards programs full cycle, we observe that best-fit solutions address three most critical questions:

Do our incentives truly promote our intended business performance?

Do our incentives help owners and execs achieve most important personal objectives?

Do our incentives self-correct across plausible good and bad business outcomes?

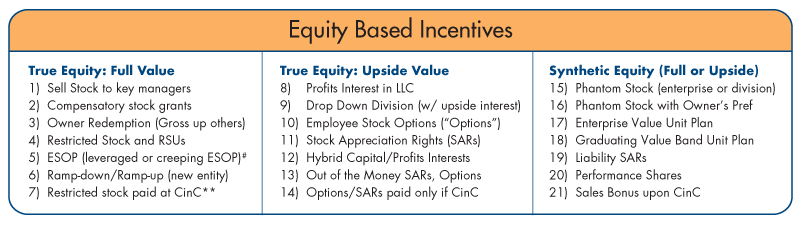

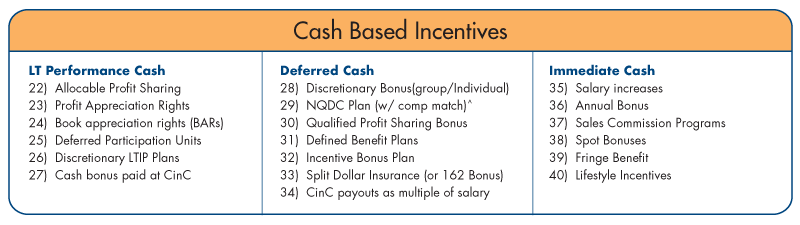

Which plans work best? Our diverse experience suggests that combination plans are most effective. Marry company equity-based awards with individual cash-based awards. Pick one each from the equity-based list and the cash-based list below. This promotes company growth while helping to preserve executives’ lifestyle.

Your executive rewards and succession program should drive growth and strategic advantage, not put your business at risk. An outside advisor can serve a vital role by providing owners and boards a wide-angle lens, a tested process and a safe venue to address these critical questions. Our E3 planning strategy does just that – spanning executive compensation, equity strategies and exit & legacy planning solutions.

Contact us and find out which combination of the Top 40 solutions may be right for your company.

Top 40 Executive Rewards*: A Pathway to Strategic Advantage

| Equity Based Incentives | ||

|---|---|---|

| True Equity: Full Value | True Equity: Upside Value | Synthetic Equity (Full or Upside) |

| 1) Sell Stock to key managers | 8) Profits Interest in LLC | 15) Phantom Stock (enterprise or division) |

| 2) Compensatory stock grants | 9) Drop Down Division (w/ upside interest) | 16) Phantom Stock with Owner’s Pre |

| 3) Owner Redemption (Gross up others) | 10) Employee Stock Options (“Options”) | 17) Enterprise Value Unit Plan |

| 4) Restricted Stock and RSUs | 11) Stock Appreciation Rights (SARs) | 18) Graduating Value Band Unit Plan |

| 5) ESOP (leveraged or creeping ESOP)# | 12) Hybrid Capital/Profits Interests | 19) Liability SARs |

| 6) Ramp-down/Ramp-up (new entity) | 13) Out of the Money SARs, Options | 20) Performance Shares |

| 7) Restricted stock paid at CinC** | 14) Options/SARs paid only if CinC | 21) Sales Bonus upon CinC |

| Cash Based Incentives | ||

|---|---|---|

| LT Performance Cash | Deferred Cash | Immediate Cash |

| 22) Allocable Profit Sharing | 28) Discretionary Bonus (group/Individual) | 35) Salary increases |

| 23) Profit Appreciation Rights | 29) NQDC Plan (w/ comp match)^ | 36) Annual Bonus |

| 24) Book appreciation rights (BARs) | 30) Qualified Profit Sharing Bonus | 37) Sales Commission Programs |

| 25) Deferred Participation Units | 31) Defined Benefit Plans | 38) Spot Bonuses |

| 26) Discretionary Long-Term Incentive Plans | 32) Incentive Bonus Plan | 39) Fringe Benefit |

| 27) Cash bonus paid at CinC | 33) Split Dollar Insurance (or 162 Bonus) | 40) Lifestyle Incentives |

| 34) CinC payouts as multiple of salary | ||

* Incentives ranked from “Value Now” to “Value Later” (Value Now near top of each of six lists). #ESOP = Employee Stock Ownership Plan, **CinC refers to Change in Control, ^NQDC = Nonqualified Deferred Compensation

Based on our work customizing incentives with hundreds of business owners, we have developed our E3 process to help privately held companies get to high performance leadership and capital succession. Our approach promotes business performance, addresses vital owners’ and managers’ personal objectives, and tests the design across a myriad of business outcomes. Our “Top 40” evolved from this work.

Communication is central to our design process. Using interviews, facilitation, design sessions and simulations, we marry the economics of value sharing with the fundamental desires of the core management team.

Interested in seeing the complete Top 40 High Performance Incentive Toolkit?

Contact our BOLD Value team via Mark.Bronfman@LFG.com for a description of each of the 40 tools and techniques setting the table for a resilient, end-to-end value sharing process.

Visit BoldValue.com to learn more about our broader portfolio of Capital Solutions at Work

Executive Compensation

Grant and or sales of equity, restricted stock, synthetic equity, profit appreciation rights, value-band plans, change of control plans, sophisticated qualified and nonqualified plans, 401(k) profit sharing, fringe benefits and more.

Equity Strategies

Choice of entity (C, S, LLC, tiered LLC), ESOP, management buyouts, redemptions, asset sales, private equity infusions, tax advantaged conversion, profits interests, and more.

Exit & Legacy Planning

Shareholder & operating agreements, buy-sell agreements & associated life insurance, investment planning, fundamental & advanced estate planning, personal financial planning, philanthropy, multigenerational planning, asset protection, tax reduction strategies and more.

CRN-5695851-051923