Equity Rules

Shaping powerful

equity models via

Sell·Pay·Convey®

by Mark Bronfman MBA, CPA*, Sagemark Consulting

Increasingly, talent-driven organizations use equity models as a key differentiator to win the war for top executives. Private companies, in particular, are crafting innovative equity models that combine a variety of tools, such as restricted stock, hybrid loans, profits interests, synthetic equity and zero cost transfers of equity. Often, these ownership plans make a material difference in a company’s ability to attract, retain, and reward co-owners, as well as key executives.

The best equity models satisfy one or more of the urgent concerns that we hear expressed by owners and boards:

Affordability: “Our success has driven up the price of ownership. Key executives can’t afford to buy in and we may lose our best people.”

Competency: “Our core markets and strategies are shifting fast, and we don’t have the right people in place. We need to realign our leadership.”

Succession: “Some of us are ready to retire, but our equity model is getting in the way of our exit strategies. Our succession plan is at risk.”

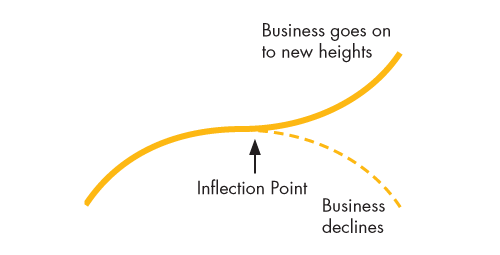

Left unanswered, challenges such as affordability, competency, and succession can trigger equity inflection points, a term coined by the late Andy Grove, former Chairman of Intel, to describe an urgent and significant change that must be addressed to ensure a company’s future.

Owners and boards can employ a number of value-sharing best practices to anticipate and navigate inflection points, and avoid crises that can threaten talent-driven companies. We call these best practices the Equity Rules. One of them, Sell·Pay·Convey®, provides a powerful decision framework for crafting highly-effective equity models for the sharing of value across and among top talent.

Attracting, retaining, and rewarding key talent in the service economy is not only an art, it is a strategic advantage. The Equity Rules and the Sell·Pay·Convey decision framework detailed in the following pages can assure and foster private company success.

Innovative equity models can combine restricted stock, hybrid loans, profits interests, synthetic equity and zero cost transfers of equity.

The Inflection Curve

Illustration from Only the Paranoid Survive by Andrew S. Grove

When owners make the wrong choices at equity inflection points, equity models become misaligned with leadership objectives. Incentives become disincentives and motivated leaders become demotivated. Equity inflection points can become company crises, especially when leadership changes are involved.

This problem is widespread. Since 2008, Noam Wasserman of Harvard Business School and Thomas Hellmann of Oxford’s Saïd Business School have studied the equity splits among more than 3,700 founders in 1,300 startups. They discovered that as the companies matured, the percentage of founders who were unhappy with their splits rose by 250 percent.1

Note that Wasserman and Hellmann only studied initial, founder-to-founder equity splits, which usually have limited financial value when they are initially set. Managing equity splits in more valuable, mature companies entails exponentially greater financial and psychological risks—and often, unintended consequences. Here are three negative consequences we commonly see:

- Talent exits: Too many equity programs pay out only on separation. The result: Retention is impaired and key executives leave the company to lock in gains.

- Unjust enrichment: When a founder is redeemed at death or disability, the buy-sell terms of shareholder agreements can inadvertently result in accretion to minority owners.

- Growth capital drain: The tax consequences of equity transfers can siphon off funds that are needed to grow the company.

The Equity Rules

The risks and negative consequences inherent to the design of equity models and the navigation of equity inflection points can be avoided by following five rules.

Owners and boards can employ a number of value-sharing best practices to anticipate and navigate inflection points, and avoid crises that can threaten talent-driven companies.

1. Stay true to your value-sharing philosophy

Many business owners and boards turn to equity as the default technique to attract, retain, and reward senior members of their team. But equity is not always the best solution: Among other things, it may not be the best alternative depending on what an owner is trying to reward. For instance, equity awards support “all-for-one and one-for-all” environments, but they are less effective as rewards for individual contributions, such as improvements in a function or business unit. Further, while equity is a good reward for growth in enterprise value, it can end up rewarding executives for the accretive or dilutive effect of changes in capital structure unrelated to performance such as redemption of key owners. So, the first rule of equity is to confirm that equity, as opposed to an alternative, such as synthetic equity, is the right tool for the task at hand.

2. Know the full cost of equity

Growing companies often seek to preserve cash by using equity instead. Still, equity is often the most expensive value-sharing alternative available to owners, and it entails a near-permanent transfer of value to an executive. Thus, it usually is not the best option for rewarding growth over a limited period of time. Further, equity is property, which precludes any tax deduction when stock is bought back by the company. Conversely, cash-based awards and synthetic equity follow the rules of compensation – meaning that upon settlement, the company can almost always deduct the costs of these programs. So, the second rule of equity is to understand the full cost of an equity program across its lifecycle.

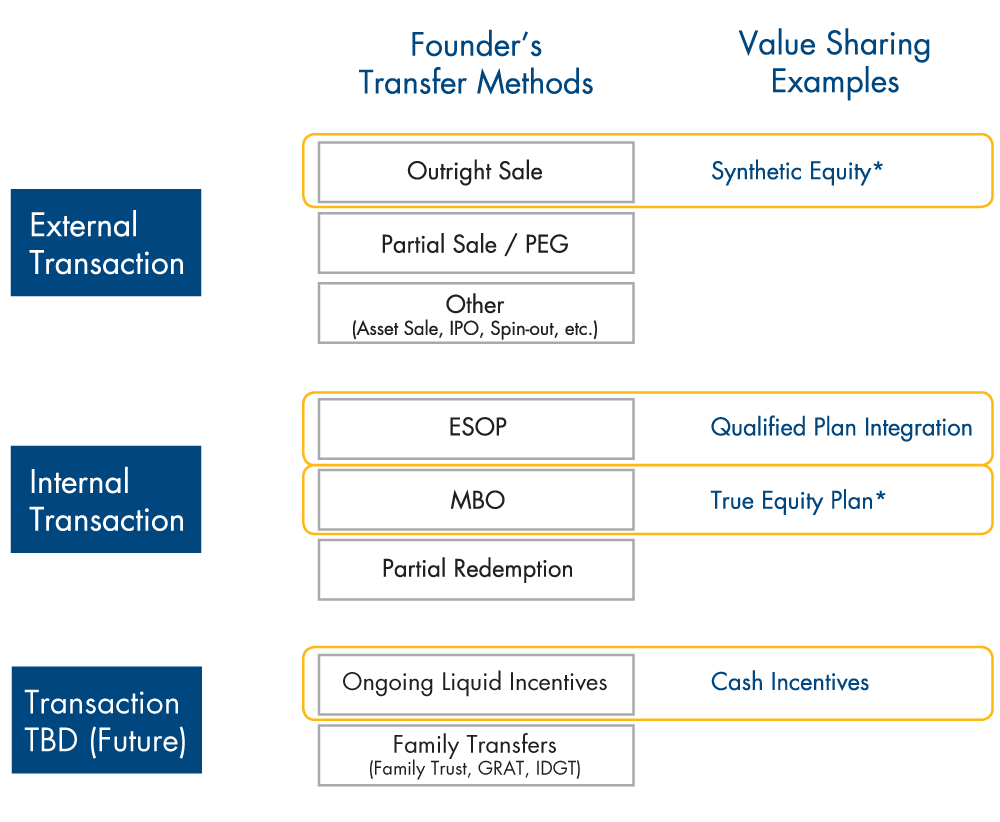

3. Honor your exit path

Prior to adopting an equity program, owners should evaluate its fit with their anticipated exit paths (see exhibit 1). Different exit paths are best served by different reward strategies. If owners plan to sell the company to insiders, an equity program may be appropriate. But if, for instance, a family-run business plans to keep the business in the family, intra-family trusts may be a better alternative than equity. So, the third rule of equity is to ensure that it aligns properly with the owners’ exit strategies.

Different exit paths are best served by different reward strategies.

Exhibit 1: Different Exit Paths Require Different Equity Models

* Profits Interests are a common substitute for a synthetic equity plan or a true equity plan (for partnerships, or an LLC taxed as a partnership).

4. Engage your executives first

Frequently, boards and CEOs ask us to develop an equity plan to overcome a lack of executive engagement. Unfortunately, if an executive team is not intrinsically motivated, throwing equity at the problem is not an effective solution. As Alexander Pepper says in his book, The Economic Psychology of Incentives, owners should focus first on ensuring that their executive teams are treated fairly, are imbued with a sense of purpose, and are provided with a full measure of recognition.2 The fourth rule of equity ensures that equity follows engagement, not vice versa.

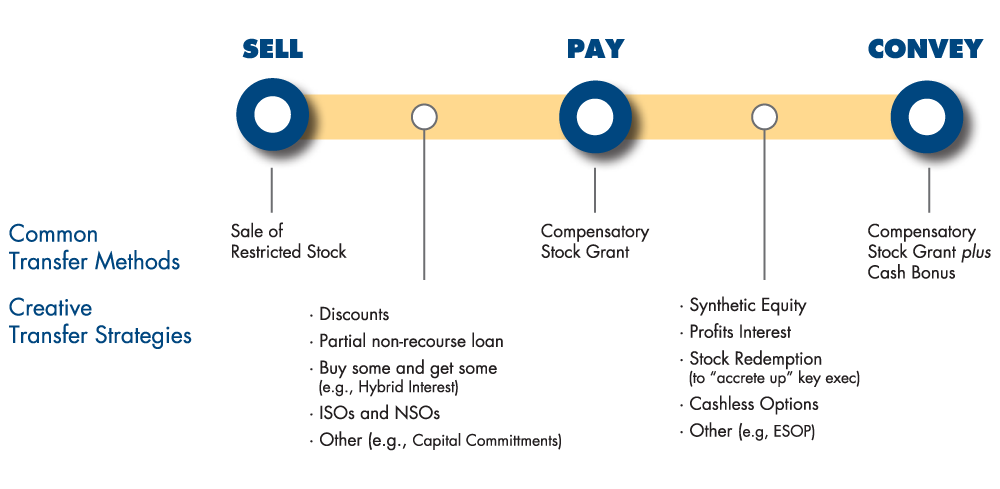

5. Master the art of equity transfer via Sell·Pay·Convey

As the above rules suggest, equity is a powerful — but not a default — tool. When equity is central to the portfolio of incentive solutions, owners, founders, and boards can seek to master the art of equity transfer — including how and when to sell equity typically via an installment note, pay equity as a compensatory bonus, or convey equity at no cost to the executive. To achieve this, we use the Sell·Pay·Convey decision framework to design robust, self-correcting equity models (see Exhibit 2).

Exhibit 2: The Art of Equity Transfer

Driving Leadership Excellence with Sell·Pay·Convey

When leaders of middle-market companies seek to establish or improve their equity models, they often are presented with off-the-shelf solutions and boiler-plate agreements. Then, after investing a great deal of effort in modifying those solutions and agreements for their situations, they may discover that the equity instrument is not the best one for navigating their unique set of equity inflection points.

Owners need a better process. Sell·Pay·Convey enables owners to design affordable ownership transfers that instill a founder’s mentality in key executives, define and support successful leadership successions, and align ownership with executive and business performance.3

Sell·Pay·Convey as its name suggests, encompasses the three principal methods for providing ownership stakes in a private company:

Sell: The first—and most obvious—method for transferring ownership is to bring in new owners by selling them a stake in the company. For instance, a new CEO is recruited in a $25 million LLC and the existing owners sell her an ownership stake for $500,000 to ensure that she has “skin in the game.”

- Pay: The second method for transferring ownership is to pay new owners a stake in the company. Think of this choice as a performance reward that is governed by an if/then proposition. For instance, if the executive team of a company exceeds budgeted goals by 10 percent, it will receive a $1 million compensatory stock grant.

- Convey: The third method for transferring ownership is to convey an entrepreneurial opportunity in the company’s future with no out-of-pocket cost to executives. For instance, an executive is given a compensatory stock grant plus a cash bonus to pay the tax on the grant.

Sell·Pay·Convey is a sound foundation for understanding and analyzing equity transfers.

Sell·Pay·Convey is a sound foundation for understanding and analyzing equity-based transfers. It helps articulate the meaning of an ownership transfer—that is, the strategic and psychological goals behind it; the structure of the ownership transfer—that is, the rights and privileges that should define it; and the value of the transfer—that is, the financial value and tax consequences. There are many possible variations on the Sell·Pay·Convey spectrum—and they can be combined into self-correcting equity models to drive leadership excellence and achieve strategic goals.

“Sell” Ownership for Skin in the Game

Sell-based equity transfers enable key executives to invest directly in a company. In buying a stake, executives align their financial interests with the company’s success in a material way—executives now have skin in the game.

“Having skin in the game is different from having performance-based bonuses and other types of compensations because there will be direct consequences to management if the value of the company’s equity drops,” explains Jim Gilreath, who recruits key executives. “Skin in the game management will definitely lose money if their company loses money.”4

The primary challenge of sell-based equity transfers is balancing scale and affordability (see sidebar “The Buy-In Paradox”). Sometimes professional services firms try to address this challenge by using book value as a proxy for the actual value of the company. But the use of book value also limits the upside of an equity stake, which has unintended consequences, such as dampening the motivation of high-performing leaders and negatively affecting retention rates. Often, a successful sell strategy includes some techniques to “de-risk” the buy-in, including:

- Valuation discounts: Controlling shareholders can apply minority discounts (as well as limited rights) to key executives when they draft shareholder and operating agreements. These discounts, which are typically 35-50 percent, make the buy-in more affordable, and limit risk for both parties.

- Affordability financing: Founders can lower buy-in barriers by offering attractive financing terms. For instance, a key executive can be offered a five-year balloon note, which provides her with the opportunity to harvest the cash needed to pay for the buy-in through distributions.

- Non-recourse debt: Founders can de-risk equity transfers by allowing key executives purchasing equity with a note to return all or a portion of ownership stakes without obligation for the underlying debt. For instance, a hybrid installment note could be 50 percent recourse and 50 percent non-recourse, and, according to many legal experts, the purchased equity may still qualify for capital gains taxes as property.

Equity stakes should be priced between the cost of a car and a house. Less than the price of a car and there’s not enough executive skin in the game; more than the price of a house and executives cannot or will not buy.

“Pay” Ownership to Reward Performance

Pay-based ownership transfers enable founders to reward key executives for superlative performance. The primary mechanism through which this is accomplished is a grant of ownership equity in lieu of cash.

If the reward is for past performance, it may be granted without restriction. If the reward is meant to drive future performance, it can be subject to vesting. That is, the key executive may retain the stock only if certain conditions are met. This vesting can be predicated on service longevity, business results, or individual performance— or any combination of them.

The primary challenge with pay-based strategies is that they can encourage key executives to “swing for the fences” by undertaking too much risk to capture the reward.5 So pay-based ownership transfers must be designed to balance value growth and value preservation— as well as short-term actions and long-term goals. There are a variety of ways to manage executive risk-taking in the design of pay strategies, three of which include:

- Compensatory stock grants: In essence, a compensatory stock grant is a bonus in the form of stock, with the executive paying the tax on the grant out of pocket. These grants make equity affordable and they may reduce undesirable risk taking, because paying the tax gives executives some skin in the game.

- Restricted stock grants with 83(b) election: A restricted stock grant is a promise to a key executive, who receives full ownership only after the vesting requirements are met. In the case of an 83(b) election, the executive can prepay the tax on an equity transfer prior to vesting, which significantly lowers the tax liability, makes the equity more affordable, and still entails some skin in the game, because the tax is not refundable (even if vesting never occurs).

- Nonqualified stock options (NSOs): Assuming a growing company value, NSOs enable an executive to buy the shares at a predetermined strike price below the FMV (fair market value) at time of exercise. Nonqualified stock options offer a high degree of design flexibility. One example is “cash-less” NSOs, which permit a net exercise in the form of cash or shares based on the value of the upside. Assume an executive has 10 NSOs at an exercise price of $10 per share and FMV of $20 per share — with a total in-the-money value of $100. A cash-less net exercise will permit the executive to receive five shares at $20 per share without any out-of-pocket exercise price (although the executive will be required to pay ordinary income tax on the bargain purchase element of the NSO exercise).

“Convey” Ownership to Encourage Entrepreneurship

Convey-based ownership transfers offer key executives a tax-free financial share in the business at no cost. Unlike sell and pay transfers, these transfers provide the greatest leverage to business executives who take calculated risks and succeed. They are the ultimate benefit for a select few executives.

The primary challenge of convey strategies is that once in place, they are not easily reversible. Thus, a founder should have a high level of confidence in a key executive before granting such a transfer. Three ways to transfer equity with no out-of-pocket cost to key executives include:

- Profits interests in a partnership:6 Profits interests take advantage of a unique provision in the tax law that enables partnerships (and LLCs taxed as partnerships) to offer zero-cost ownership grants that operate as true equity for any increase in value. Most legal experts agree that after a two-year holding period, they are taxed as capital gains. In addition, profits interests feature a high degree of design flexibility in terms of vesting, profit allocation and value upon liquidation.

- Stock bonus with a tax true-up: By adding a cash bonus to stock grants, owners of companies with sufficient taxable income can execute an ownership transfer at no cost to a key executive or to the company. For instance, a company can offer a $60,000 stock grant and a $40,000 cash bonus to cover all taxes. The executive has $100,000 in income and uses the cash bonus to pay the resulting tax. Meanwhile, the company deducts $100,000, resulting in a $40,000 tax benefit. Neither party incurs a net out-of-pocket cost. (Taxation assumed to be 40% for company and executive).

Partial redemptions: Partial share redemptions enable owners to raise a key executive’s stake in the company at no cost, essentially via an “accrete up” ownership transfer. Partial redemptions often work best in companies with uncomplicated ownership structures and excess cash in the enterprise. The following example illustrates how a minority owner can go from 10 percent to 20 percent with no additional investment. Assume that a company founder holds 90 shares in a company (for 90 percent ownership) and the CEO holds 10 shares (for 10 percent ownership). The company redeems and retires 50 of the founder’s shares—now he holds 40 shares (or an 80 percent stake of the 50 remaining outstanding shares). The CEO still holds 10 shares, but now that is a 20 percent stake with no additional out-of-pocket costs.7

Combining Sell·Pay·Convey for Maximum Effect

The examples above illustrate the kinds of solutions that the Sell·Pay·Convey decision framework offers. However, the full power of the framework is only revealed when it is used to bundle solutions to accomplish multiple objectives— simultaneously getting key executives to put skin in the game, rewarding superlative performance, and encouraging them to behave as entrepreneurs.

To see this in action, we can revisit Bill R., the founder of Upshot Engineering. Bill asks one of his advisory board members, Sally H., to join the firm as its chief growth officer. Sally, who would have to abandon her consulting business, is interested, but only if the offer includes a significant equity stake in Upshot. Bill is willing to sell Sally a 20 percent stake in the $12 million company. The problem: the stake is valued at $2.4 million, but Sally is unwilling to invest more than $400,000.

To finesse the deal, Bill turns to an outside advisor. The advisor asks Bill and Sally to consider scenarios for how the value of the company might change in the coming years—and how they might allocate that value. They agree that if the business does not grow, Sally should keep only a small ownership stake. If she grows the business’s value to $20 million within 5 years, she should have a 10-15 percent stake. And if she builds the business’s value beyond $30 million, she should have 15-20 percent stake. Based on these scenarios, the advisor recommends a combination of Sell·Pay·Convey tools, as follows:

- Bill will sell 4 percent of the business to Sally for $300,000 —a figure based on an independent valuation and a 40 percent minority discount. Sally will pay $75,000 down and the rest in equal installments of $75,000 from her annual bonuses over the next 3 years.

- Upshot will pay Sally 4 percent of the business as a $300,000 restricted stock bonus, subject to her promotion to President and specific business metrics. Sally makes an 83(b) election and prepays $120,000 in tax, thereby locking in the total tax bill on these restricted shares. Upshot will receive $300,000 deduction and will use the tax benefit it receives to provide Sally with a half recourse/half non-recourse loan to pay that tax.

- Upshot will convey 20 percent of the upside of the business to Sally via

a grant of profits interest. It costs Sally nothing, and has no value unless the company’s value increases. However, Sally will receive 20 percent of the growth above the current $12.5 million value of Upshot.

The Sell·Pay·Convey equity model that not only convinces Sally to join Upshot Engineering, but also motivates her to perform at full capacity. It requires that she make an affordable investment in the company, giving her skin in the game. It provides her with an entrepreneurial interest in the company, without encouraging her to take undue managerial risks (see Exhibit 3).

Too often, owners are unaware of their value-sharing alternatives and default to the limited selection of public company options.

Exhibit 3: Upshot Engineering Self-Correcting Equity Model

Like all ownership transfers, Bill and Sally’s agreement will need to be fully implemented. Buy-sell terms must be integrated into governing documents to specify liquidity triggers such as separation, death and/or executives’ put rights. Equity pricing terms, including discounts, need to be specified in advance via either an annual valuation or some predetermined formula. Ongoing plan administration must be defined to reinforce the benefits of the plan to key executives. And the plan should be updated periodically with a holistic advisory team to address issues from behavioral motivation to changing tax laws. The best practice is to treat equity transfer as a part of the company’s strategic fabric, not a one-off transaction.

Equity Rules for Strategic Advantage

Equity inflection points triggered by affordability, competency, and succession challenges can come in rapid-fire succession in middle-market companies. But owners shouldn’t respond in a knee-jerk way by immediately offering equity to lock in the key talent so critical for business success. They also should avoid the temptation to accept off-the-shelf solutions, which often do not adequately address the behavioral and risk profiles of owners, executives, and private companies.

Instead, owners should default to the five Equity Rules and then, use a qualified team of advisors and Sell·Pay·Convey to design an equity model that best serves their needs and their companies. In doing so, they can design a balanced solution. Better yet, they can be strategic and explore their options in advance. Owners who proactively address equity inflection points rarely face equity crises.

End Notes

1 Noam Wasserman and Thomas Hellman, “The Very First Mistake Most Startup Founders Make” Harvard Business Review, February 23, 2016.

2 Alexander Pepper and PwC, “Making Executive Pay Work, The Psychology of Incentives,” 2012.

3 Chris Zook and James Allen, authors of “The Founder’s Mentality: How to Overcome the Predictable Crises of Growth” Harvard Business Review Press, 2016, define it as “an insurgent’s mission, an owner’s mindset, and obsession with the front line.”

4 Jim Gilreath, “Skin in the Game: No Longer Just a C-Level Employee” (Made for Success Publishing, 2016).

5 Wm. Gerard Sanders and Donald C. Hambrick, “Swinging for the fences: The effects of CEO stock options on company risk-taking and performance” The Academy of Management Journal, October 2007.

6 Mark C. Bronfman, The Profits Interest: The Frank Lloyd Wright Approach to Ownership and Incentives.

7 The tax-free nature of such redemptions is subject to certain rules — including IRS section 302. Further, a partial redemption strategy may result in a lower enterprise value depending on how the redemption program is executed.

* Licensed, not practicing.

CRN-5482916-022423

The best practice is to treat equity transfer as a part of the company’s strategic fabric, not a one-off transaction.