RESEARCH AND ANALYSIS

NAVIGATING THE JOURNEY FROM

LEADERSHIP TO LIQUIDITY

RESEARCH AND ANALYSIS

NAVIGATING THE JOURNEY FROM LEADERSHIP TO LIQUIDITY

Many Owners Fail at Succession … You Don’t Have To

Our experience and research show that many business owners are exposed to repeatable traps hindering succession. 80% of business owner wealth is trapped in their business. 80% of owners are neither mentally ready nor financially ready for succession. 80% of owners who aspire to sell their company either do not sell or later “regretted selling” a year after the deal.

Our “Leadership to Liquidity” Succession Process offers a more systematic route to transition by shining light on three types of succession readiness:

Personal Readiness: Mental & financial readiness and relevance “post-deal”

- Business Readiness: Leadership succession, entity & tax structure and key value drivers

- Market Readiness: Transfer options, market conditions, and planning for capital exit

After helping hundreds of business owners with strategic transition, we observe five key Lessons of High Performance Succession

- Explore your succession pathways early in the process

- Harmonize your succession pathway, business valuation and value gap

- Craft an equity model that works for both exit and entry of owners and talent

- Earn your cost of capital and then pay yourself first

- Engage top talent in the process

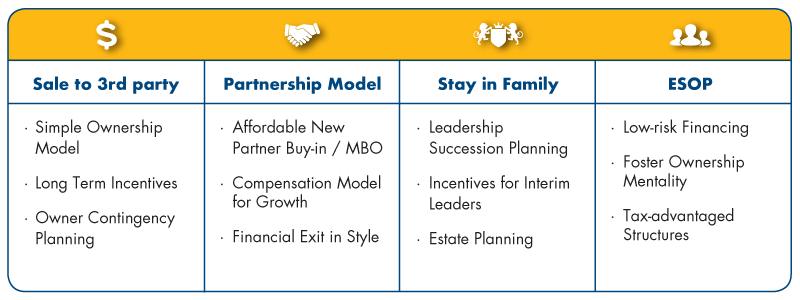

Harmonize each of the Four Succession Pathways with a Unique Equity Model*

|

|

|

|

|---|---|---|---|

| Sale to 3rd party | Partnership Model | Stay in Family | ESOP |

| Simple Ownership Model | Affordable New Partner Buy-in / MBO | Leadership Succession Planning | Low-risk Financing |

| Long Term Incentives | Compensation Model for Growth | Incentives for Interim Leaders | Estate Planning |

| Owner Contingency Planning | Financial Exit in Style | Foster Ownership Mentality | Tax-advantaged Structures |

* Default succession pathway is liquidation

The Leadership to Liquidity Process:

Equity model defines how owners & leaders enter and exit the company equity model, in style, consistent with the selected succession pathway.

Here are some of the key incentive tests you may wish to consider before implementation of a major incentive plan:

Affordability: Can we afford the plans now and in the future – even in the event of extreme volatility?

Competency: Can we use these plans to attract and retain the most precious talent – regardless of whether this is the CXO or senior managers?

Succession: Can we use these plans to help us execute on our leadership and capital succession plan – such as: change in control, going perpetual, stay in the family or ESOP?

Simplicity: Can we explain the program easily to our key talent and the plan is easy to adopt from a book, tax and administrative perspective?

Resiliency: Can we modify or dramatically change the plans given changes in our competitive landscape, business priorities and people strategy?

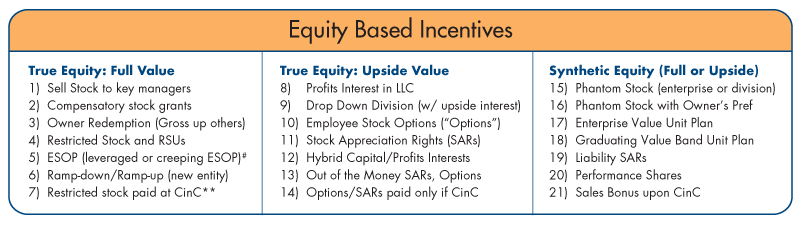

Top 40 Executive Rewards*: A Pathway to Strategic Advantage

| Equity Based Incentives | ||

|---|---|---|

| True Equity: Full Value | True Equity: Upside Value | Synthetic Equity (Full or Upside) |

| 1) Sell Stock to key managers | 8) Profits Interest in LLC | 15) Phantom Stock (enterprise or division) |

| 2) Compensatory stock grants | 9) Drop Down Division (w/ upside interest) | 16) Phantom Stock with Owner’s Pre |

| 3) Owner Redemption (Gross up others | 10) Employee Stock Options (“Options”) | 17) Enterprise Value Unit Plan |

| 4) Restricted Stock and RSUs | 11) Stock Appreciation Rights (SARs) | 18) Graduating Value Band Unit Plan |

| 5) ESOP (leveraged or creeping ESOP)# | 12) Hybrid Capital/Profits Interests | 19) Liability SARs |

| 6) Ramp-down/Ramp-up (new entity) | 13) Out of the Money SARs, Options | 20) Performance Shares |

| 7) Restricted stock paid at CinC** | 14) Options/SARs paid only if CinC | 21) Sales Bonus upon CinC |

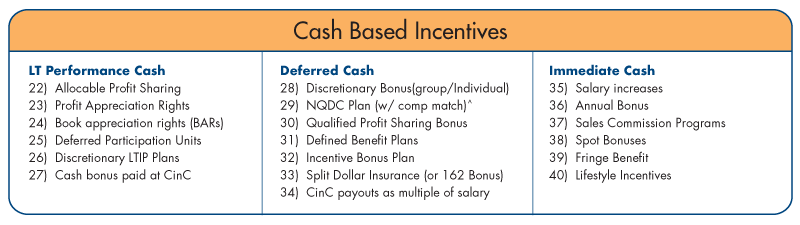

| Cash Based Incentives | ||

|---|---|---|

| LT Performance Cash | Deferred Cash | Immediate Cash |

| 22) Allocable Profit Sharing | 28) Discretionary Bonus (group/Individual) | 35) Salary increases |

| 23) Profit Appreciation Rights | 29) NQDC Plan (w/ comp match)^ | 36) Annual Bonus |

| 24) Book appreciation rights (BARs) | 30) Qualified Profit Sharing Bonus | 37) Sales Commission Programs |

| 25) Deferred Participation Units | 31) Defined Benefit Plans | 38) Spot Bonuses |

| 26) Discretionary LTIP Plans | 32) Incentive Bonus Plan | 39) Fringe Benefit |

| 6) Ramp-down/Ramp-up (new entity) | 13) Out of the Money SARs, Options | 20) Performance Shares |

| 27) Cash bonus paid at CinC | 33) Split Dollar Insurance (or 162 Bonus) | 40) Lifestyle Incentives |

| 34) CinC payouts as multiple of salary | ||

* Incentives ranked from “Value Now” to “Value Later” (Value Now near top of each of six lists). #ESOP = Employee Stock Ownership Plan, **CinC refers to Change in Control, ^NQDC = Nonqualified Deferred Compensation

CRN-2244369-091718