RESEARCH AND ANALYSIS

SIZING THE DEAL BONUS FOR KEY TALENT—

THE ART OF BALANCING FAIRNESS & AFFORDABILITY IN SHARING THE TRANSACTION LIQUIDITY

RESEARCH AND ANALYSIS

SIZING THE DEAL BONUS FOR KEY TALENT—

THE ART OF BALANCING FAIRNESS & AFFORDABILITY

IN SHARING THE TRANSACTION LIQUIDITY

by Joel Kim, Sagemark Consulting

Change-in-control — or deal — bonuses often serve as the centerpiece of long-term incentive programs for executives of private companies. Unlike public companies that can drive performance with stock-based compensation, these bonuses can be the best long-term incentive for attracting, retaining and motivating key talent, while avoiding the friction and tax complications inherent to true equity in private companies.

Designing deal bonuses may seem simple at first, but few owners are familiar with the process of sizing and structuring payouts that can satisfy both their own endowment targets and provide meaningful economic benefit for their executive teams. Moreover, the art of managing the conflicts that often arise around dilution and fairness requires more prudence and finesse than is commonly realized.

As incentive design facilitators, we are often asked how to size, structure, and scale deal bonuses. For answers, we look to our experience assisting numerous private company clients with annual revenues of $15M-$2B, especially professional services firms in IT, engineering, consulting, finance, etc. Here are our findings:

Average deal bonus sizing, scale, and structure

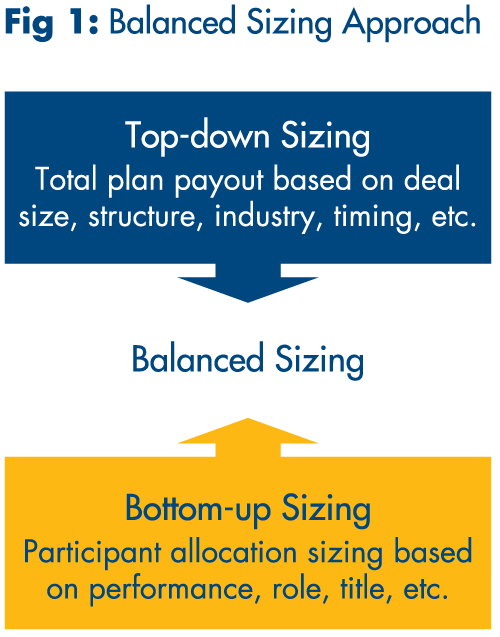

Bonus composition: All deal bonuses are composed of a top-down share — percentage of total payout based on overall deal parameters, such as size, structure, industry, timing, etc. — and a bottom-up share — an individual allocation based on participant performance, role, title, etc. (See Fig 1.)

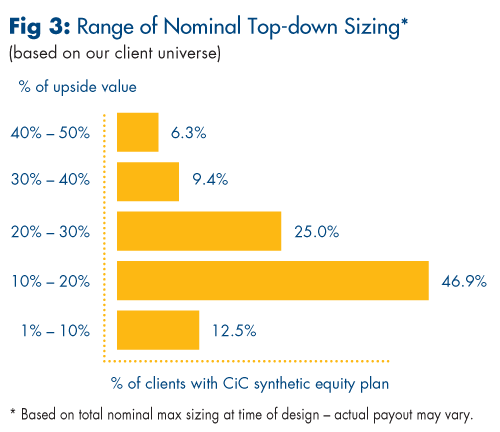

Average top-down sizing: The overall value-share sizing varies widely, but the average range is 15% to 20% of upside value.

Average bottom-up sizing: As a multiple of annual cash compensation, the average individual payout range is 3x to 6x or more for C-suite executives. Special talent is sometimes rewarded above that range for outsized contribution, sustained high performance, etc. Pay philosophy on short-term vs. long-term pay is one key driver here.

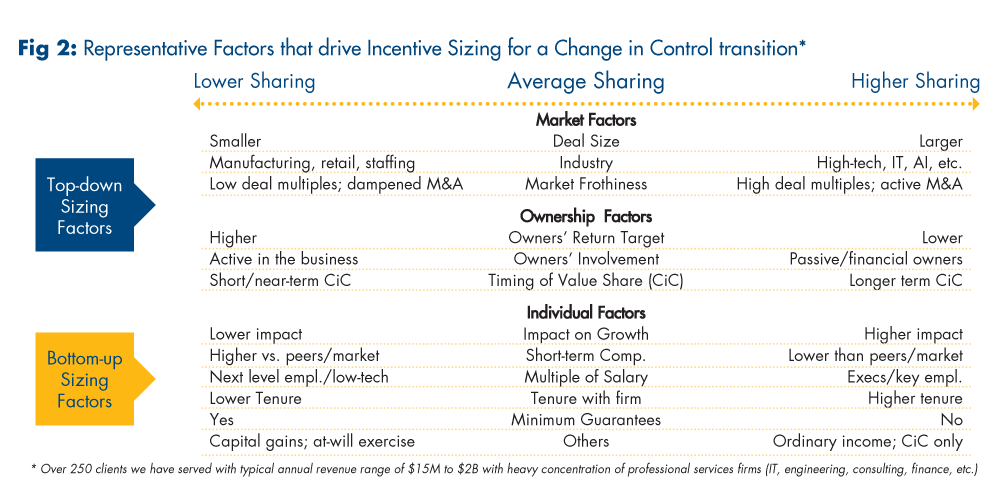

Most important sizing determinants: Among the many factors in sizing deal bonuses, deal size, anticipated timing of deal, and owner’s involvement in the company are some of the most important. (See Fig 2.)

Most popular sizing structure: A graduated sharing scheme via Value Band or Straight Line (Smooth Upslope) in a synthetic equity format is the most common deal bonus structure. It enables owners to stimulate value creation by providing key talent with a scalable, customizable incentive that is commensurate with company growth.

Important nuances to consider in crafting a deal bonus

Owner’s personal endowment as a key sizing element: Establishing the personal endowment targets of business owners should be a major element in the top-down sizing of a deal bonus, but those targets need to be set in a nuanced and sensitive manner. The amounts from distributions and/or sales transactions, the timing of such liquidities, and “sweat equity,” are some of the personal issues that must be considered, but they should be balanced in a way that mitigates potential conflicts with the liquidity needs of the company and its key talent group. A careful review of priority objectives and strategic requirements is needed to craft the most appropriate sizing structure and incentive design parameters. (Fig 3 depicts a cross-section range of upside value-sharing percentages adopted by our clients.)

Synthetic equity is vastly more popular than true equity and helps facilitate smooth transactions: Due to reduced tax and operating complexities inherent to synthetic equity, it is the most common (over 80% of value-share projects in our client universe) and desired incentive structure for rewarding key talent, particularly when change in control is the anticipated exit pathway. Synthetic equity offers flexibility in design features, sizing dynamics, individual/team allocation, and tax/regulatory maneuvering, as well as built-in provisions for golden handcuffs, handling various types of transactions, etc.

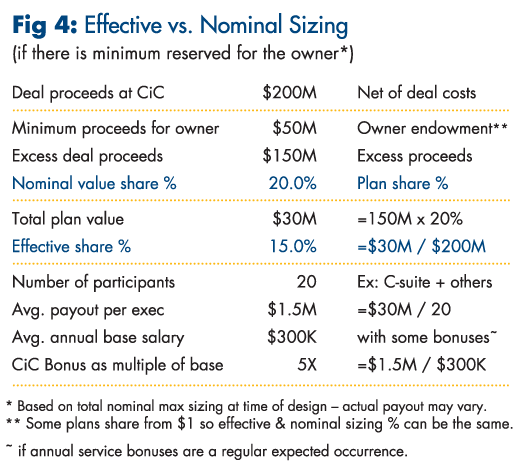

Optics and nuances: Expressions of value-share sizing can take various forms, including plain upside sharing, sharing from dollar one, graduated sharing, upside with increasing minimum to reflect time value of money, various allocation methodologies, and true-up for taxes in special cases. (Fig 4 shows an example of nominal, effective, and multiple-of-salary sizing for a hypothetical deal). The right mix of these elements can have a material impact on overall and individual value-share sizing. It becomes especially critical when nuanced or custom sizing is needed without disturbing company’s current governance and compensation structures, and to help prevent unpleasant surprises in payout liabilities.

CRN-5991592-102223